Irs Schedule D 2024 Form 1099

Irs Schedule D 2024 Form 1099 – The 2024 tax Income (Form 1099-INT), State Tax Refunds (Form 1099-G), Unemployment Benefits (Form 1099-G) and offer assistance with many other documents. The two volunteer groups do not help . Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. .

Irs Schedule D 2024 Form 1099

Source : www.nslawservices.orgWhen Is Schedule D (Form 1040) Required?

Source : www.investopedia.comIRS Delays 2023 Form 1099 K Threshold, Introduces $5,000 for 2024

Source : www.drakesoftware.comFiling taxes for your restricted stock, restricted stock units, or

Source : workplaceservices.fidelity.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaHow Is Crypto Taxed? (2024) IRS Rules and How to File | Gordon Law

Source : gordonlaw.comSchedule d: Fill out & sign online | DocHub

Source : www.dochub.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

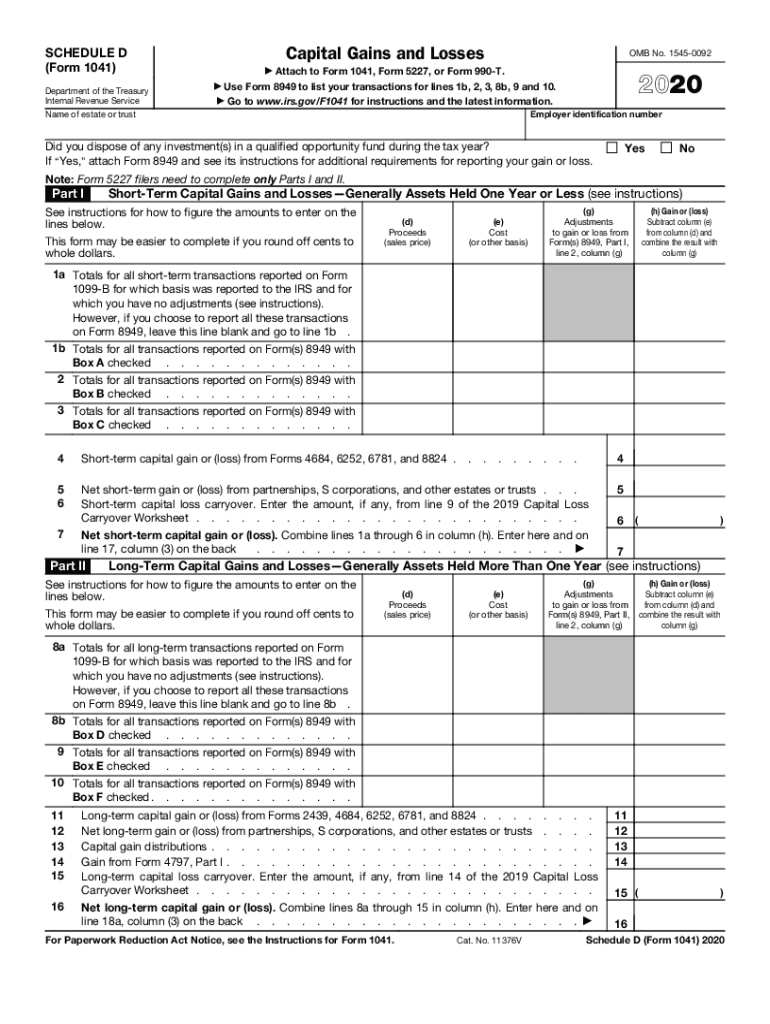

Source : www.investopedia.comSchedule D (Form 1041) 2023 Fill Online, Printable, Fillable

Source : form-1041-schedule-d.pdffiller.comIRS Delays 2023 Form 1099 K Threshold, Introduces $5,000 for 2024

Source : www.drakesoftware.comIrs Schedule D 2024 Form 1099 Free Tax Clinic Bethpage VITA at Touro Law University – Nassau : Here’s what you need to know about tax form due dates and what to do if you don’t receive yours on time. Taxpayers are generally on the look out for Form W-2, which due on Jan. 31, 2024. . The agency recently announced revisions to its frequently asked questions (FAQs) for Form 1099-K, used for reporting payment card and third-party network transactions. The update, outlined in Fact .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)